InspireMD Reports Financial Results for the Fourth Quarter and Year Ended December 31, 2015

BOSTON, MA – March 28, 2016 – InspireMD, Inc. (NYSE MKT: NSPR) (“InspireMD” or the “Company”), a leader in embolic prevention systems (EPS), neurovascular devices and thrombus management technologies, today announced its financial and operating results for the fourth quarter and year ended December 31, 2015.

In 2015, InspireMD advanced its strategic transition into the carotid and neuro interventional markets utilizing its proprietary MicroNet™TM technology. Key activities include announced:

- Consistent, positive clinical results, with therapeutic benefits sustained at 12 months from the CGuardTM CARENET trial, as well as the ongoing investigator-led PARADIGM study;

- Expanded regulatory footprint, with CGuardTM approvals in Argentina and Columbia;

- Strategic distribution agreement with global interventional therapies company Penumbra, Inc., a market leader in the interventional neuroradiology and peripheral vascular markets;

- Initiated European commercial market launch activities of CGuardTM with Penumbra Inc;

- Strengthened intellectual property coverage; and

- Operational and financial realignment, with ongoing implementation of a comprehensive cash management program.

Sol Barer, Chairman of the Board of InspireMD, commented, “We close 2015 with continued focus and sense of urgency to execute on our strategic plan. While a challenging year, we note progress made. We look forward to completing additional initiatives that position us for sustainable growth, including our ongoing management transition plan with attention on our European commercial and development activities, which were aided by our recent capital raise. Gross proceeds from the March 16th, 2016 private placement and public offering were approximately $1.7 million.”

Dr. Barer continued, “We are also pleased with consistent, positive feedback from the CGuardTM launch and are encouraged by its early market traction. In addition, our development efforts in the high value neurovascular field are progressing through positive development milestones.. We look forward to providing timely and continuous updates as we execute on our plans.”

Recent Operating Highlights:

COMMERCIAL

- Initial European commercial launch of CGuardTM by Penumbra.

- Continued focus on expanding European commercial activities in new geographies.

REGULATORY / CLINICAL / PRODUCT DEVELOPMENT

- Announced positive 12 month follow up data from its CGuardTM CARENET (CARotid Embolic protection Study using microNET) trial which demonstrated zero strokes or stroke-related deaths at 12 months.

- Received a DEKRA medical device certification for the manufacture and commercialization of its CGuardTM delivery catheter. The certification also allows the Company to add-on facilities for additional manufacturing work flow.

- Advanced next generation neurovascular flow diverter program with positive pre-clinical data results.

- Received regulatory approvals to commercialize CGuardTM in Colombia and Argentina.

FINANCIAL

- Comprehensive and active cash management program, including a March 16th, 2016 pricing of an underwritten public offering of 1,900,000 shares of its common stock and warrants to purchase up to 950,000 shares of common stock and a concurrent private placement of 1,033,051shares of its common stock and warrants to purchase up to 516,526 shares of common stock to certain of the Company’s directors.

- Announced one-for-ten reverse stock split effective October 1st, 2015.

- Continued implementation of cost containment activities while supporting key development programs.

Quarter Ended December 31, 2015 Financial Results

Revenue for the fourth quarter ended December 31, 2015 decreased $0.4 million to $0.5 million compared to $0.9 million during the same period in 2014. The 2015 period included an expected decline in sales of MGuard™ Prime EPS associated with the trend of doctors increasingly using drug eluting stents rather than bare metal stents in STEMI offset by sales of our new product CGuard™ EPS, which was partially launched in October 2014.

The Company’s gross loss for the quarter ended December 31, 2015 was $0.1 million compared to a gross profit of $0.4 million for the same period in 2014. The decrease of 134.5% was largely attributable to the decrease in product revenues and an increase of write-offs and other related adjustments of MGuard™ Prime EPS inventory due to the trend of increased usage of drug eluting stents rather than bare metal stents in STEMI patients., however, were partially offset by a decrease in labor and material costs attributable to lower revenues.

Total operating expenses for the quarter ended December 31, 2015 were $2.5 million, a decrease of 48.9% compared to $4.8 million for the same period in 2014. This decrease was primarily due to a reduction of expenses related to MGuard™ Prime EPS’s MASTER II trial, which was suspended in October 2014, a decrease in compensation related expenses and other savings associated with our cost reduction plan.

The loss from operations for the quarter ended December 31, 2015 was $2.6 million, a decrease of 41.3% compared to a loss of $4.4 million for the same period in 2014.

Financial expenses for the quarter ended December 31, 2015 was $0.2 million, a decrease of 28.1% compared to the same period in 2014. This decrease was primarily due to a decrease in interest expenses due to the reduction in principal of our outstanding indebtedness.

The net loss for the quarter ended December 31, 2015 totaled $2.9 million, or $0.37 per basic and diluted share, compared to a net loss of $4.8 million, or $1.19 per basic and diluted share, in the same period in 2014.

Non-GAAP net loss for the quarter ended December 31, 2015 was $2.3 million, or $0.31 per basic and diluted share, a decrease of 37.9% compared to a non-GAAP net loss of $3.8 million, or $0.94 per basic and diluted share, for the same period in 2014. The non-GAAP net loss for the quarter ended Dec 31, 2015 primarily excludes $0.5 million of share-based compensation. The non-GAAP net loss for the quarter ended December 31, 2014 primarily excludes $1.0 million of share-based compensation.

Twelve Months Ended December 31, 2015 Financial Results

Revenue for the twelve months ended December 31, 2015 decreased $0.5 million to $2.3 million compared to $2.8 million during the same period in 2014. The 2015 period included an expected decline in sales of MGuard™ Prime EPS associated with the trend of doctors increasingly using drug eluting stents rather than bare metal stents in STEMI offset by sales of our new product CGuard™ EPS, which was partially launched in October 2014.

The Company’s gross loss for the twelve months ended December 31, 2015 was $0.3 million, a decrease of 137.8% compared to a gross profit of $0.8 million for the same period in 2014. The decrease was largely attributable to the decrease in product revenues, an increase in labor and material costs attributable to higher costs for CGuard™ EPS, an increase of write-offs and other related adjustments of MGuard™ Prime EPS inventory due to the trend of increased usage of drug eluting stents rather than bare metal stents in STEMI patients. and longer shelf life requirements.

Total operating expenses for the twelve months ended December 31, 2015 were $14.2 million, a decrease of 42.0% compared to $24.5 million for the same period in 2014. This decrease was primarily due to a reduction of expenses related to the suspension of the MGuard MASTER II trial, a decrease in compensation related expenses and other savings associated with our cost reduction plan offset by restructuring and impairment expenses.

The loss from operations for the twelve months ended December 31, 2015 was $14.5 million, a decrease of 38.9% compared to a loss of $23.7 million for the same period in 2014.

Financial expenses for the twelve months ended December 31, 2015 decreased 20.9% to $1.1 million from $1.4 million during the same period in 2014. This decrease was primarily due to a decrease in interest expenses due to the reduction in principal of our outstanding indebtedness.

The net loss for the twelve months ended December 31, 2015 totaled $15.6 million, or $2.23 per basic and diluted share, compared to a net loss of $25.1 million, or $7.09 per basic and diluted share, in the same period in 2014.

Non-GAAP net loss for the twelve months ended December 31, 2015 was $11.8 million, or $1.69 per basic and diluted share, a decrease of 43.5% compared to a non-GAAP net loss of $20.9 million, or $5.91 per basic and diluted share, for the same period in 2014. The non-GAAP net loss for the twelve months ended December 31, 2015 primarily excludes $3.1 million of share-based compensation and $0.6 million of expense related to an impairment of a royalties buyout asset. The non-GAAP net loss for the twelve months ended December 31, 2014 primarily excludes $4.1 million of share-based compensation.

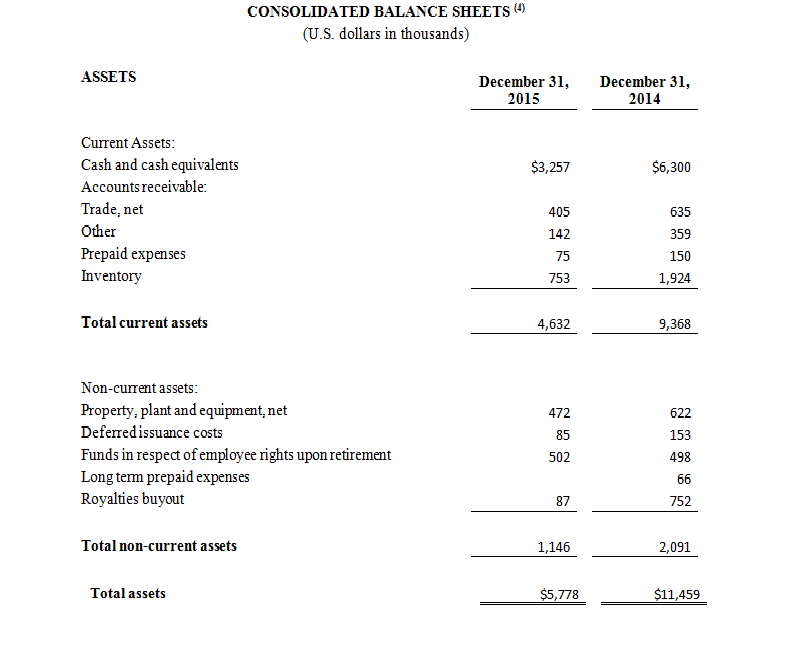

Cash and Cash Equivalents

As of December 31, 2015, cash and cash equivalents were $3.3 million, compared to $6.5 million as of September 30, 2015 and $6.3 million as of December 31, 2014.

No Conference Call Scheduled

The Company is not hosting a conference call to discuss fourth quarter and year end December 31, 2015 results. Additional updates will be provided as they become available.

About InspireMD, Inc.

InspireMD seeks to utilize its proprietary MGuard™ with MicroNet™TM technology to make its products the industry standard for embolic protection and to provide a superior solution to the key clinical issues of current stenting in patients with a high risk of distal embolization, no reflow and major adverse cardiac events.

InspireMD intends to pursue applications of this MicroNet™ technology in coronary, carotid (CGuardTM), neurovascular, and peripheral artery procedures. InspireMD’s common stock is quoted on the NYSE MKT under the ticker symbol NSPR.

Forward-looking Statements

This press release contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control, and cannot be predicted or quantified and consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) market acceptance of our existing and new products, (ii) negative clinical trial results or lengthy product delays in key markets, (iii) an inability to secure regulatory approvals for the sale of our products, (iv) intense competition in the medical device industry from much larger, multinational companies, (v) product liability claims, (vi) product malfunctions, (vii) our limited manufacturing capabilities and reliance on subcontractors for assistance, (viii) insufficient or inadequate reimbursement by governmental and other third party payers for our products, (ix) our efforts to successfully obtain and maintain intellectual property protection covering our products, which may not be successful, (x) legislative or regulatory reform of the healthcare system in both the U.S. and foreign jurisdictions, (xi) our reliance on single suppliers for certain product components, (xii) the fact that we will need to raise additional capital to meet our business requirements in the future and that such capital raising may be costly, dilutive or difficult to obtain and (xiii) the fact that we conduct business in multiple foreign jurisdictions, exposing us to foreign currency exchange rate fluctuations, logistical and communications challenges, burdens and costs of compliance with foreign laws and political and economic instability in each jurisdiction. More detailed information about the Company and the risk factors that may affect the realization of forward looking statements is set forth in the Company’s filings with the Securities and Exchange Commission (SEC), including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors and security holders are urged to read these documents free of charge on the SEC’s web site at http://www.sec.gov. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events or otherwise.

Investor Contacts:

InspireMD, Inc.

Craig Shore

Chief Financial Officer

Phone: 1-888-776-6804 FREE

Email: craigs@inspiremd.com

PCG Advisory

Vivian Cervantes

Investor Relations

Phone: (212) 554-5482

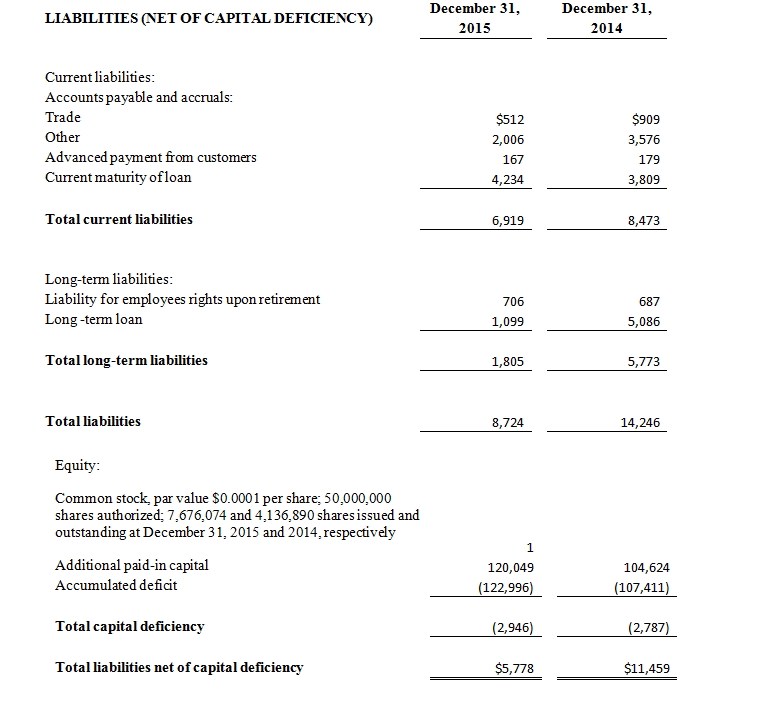

(1) All financial information for the twelve months ended December 31, 2015 is derived from the Company’s 2015 audited financial statements and all financial information for the twelve months ended December 31, 2014 is derived from the Company’s 2014 audited financial statements, as disclosed in the Company’s Annual Report on Form 10-K, for the twelve months ended December 31, 2015 filed with the Securities and Exchange Commission. All financial information for the three months ended December 31, 2015 and 2014 is derived from the Company’s unaudited, internal financial statements.

(2) Our non-GAAP net loss is presented as management uses this supplemental non-GAAP financial measure to evaluate performance period over period, analyze the underlying trends in our business, and establish operational goals and forecasts that are used in allocating resources. We believe by presenting this additional measurement, we are providing investors with greater transparency to the information used by our management for our financial and operational decision-making, as well as allowing investors to see our results “through the eyes” of management. We further believe that providing this information assists our investors in understanding our operating performance and the methodology used by management to evaluate and measure such performance.

(3) Non-cash financial income relates to the issuance of shares as a result of the anti-dilution rights of our March 2011 investors.

(4) All December 31, 2015 financial information is derived from the Company’s 2015 audited financial statements and all December 31, 2014 financial information is derived from the Company’s 2014 audited financial statements, as disclosed in the Company’s Annual Report on Form 10-K, for the twelve months ended December 31, 2015 filed with the Securities and Exchange Commission.